Changes to the off-payroll working rules for the private sector will go ahead from April 2020. The rules based on the changes in the public sector in April 2017, will make engagers, other than those considered “small” responsible for determining whether the IR35 rules apply to the contractors they hire and ensuring the necessary PAYE tax and National Insurance contributions are paid.

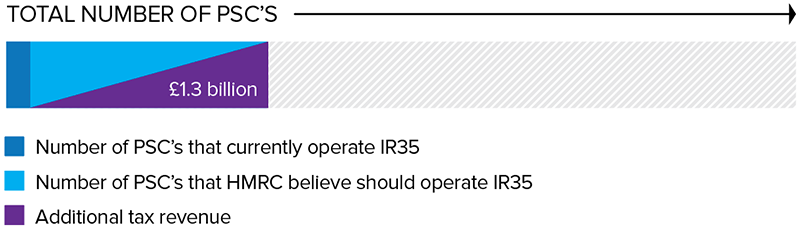

HMRC feel it is time to change the rules. Whilst IR35 is not new, it was introduced in April 2000, the changes are in light of statements detailing the estimates of tax lost through non-compliance under the existing legislation. It is clear the contracting sector is not happy with the upcoming changes, however they will be happening. With HMRC of the belief a third of PSC’s should operate IR35 and only 3% currently do the reason for change is based in logic. With limited resources targeting the engager should allow HMRC to bring in the additional £1.3 billion tax revenue they currently believe that they are currently missing out on.

The rules have been there for over a decade, and are intended to prevent businesses and individuals avoiding the increased tax and NIC costs associated with employment by interposing an intermediary- the personal service company between an individual and the business they work for. It is not intended to catch genuine self-employed individuals, but it has become an issue with the contractors incorrectly categorising their status leading to substantial loss in tax and NIC.

The draft legislation also includes provisions to ensure that all parties in the labour supply chain are aware of the engager’s decision, and will introduce a statutory engager -led status disagreement process. For a status determination to be valid it has to include the reasons why the determination was reached. There is a burden on the engager to take reasonable care in reaching the decision. If a contractor does not agree with a determination they can challenge said determination. From the point of challenge the engager has 45 days to respond and provide the reasons why they believe their determination was correct. It must be noted that if the contractor does not agree with the response received, there is no legislative right of appeal to HMRC. The contractor would need to make a general approach to HMRC and ask them to get involved, which in practice may be difficult? If the engager does not follow the process correctly and does not respond to a challenge they will become the fee payer and as such the associated liabilities.

The successful implementation of the rules is completely dependent on engagers being able to correctly determine whether IR35 is applicable. This effectively means that potentially engagers who are not tax experts (nor should they be expected to be) must make a status determination. The HMRC’s Check Employment Status for tax (CEST) has received criticism that it is not fit for purpose, but currently remains the best tool for engagers to use as HMRC would be bound by the determination of the tool that they have provided. With the HMRC having a losing record on cases on IR35 since the start of 2018, it would seem to demonstrate that CEST is unable to take into account the differing complex nature of different working practices, and that a questionnaire that does not even consider mutuality of obligation will struggle to create robust determination decisions. There will seemingly be updates to CEST and we must wait to see if changes translate into improvements.

The main lesson that can be taken from the public sector implementation is that the more time spent preparing the better. The lead in period of 5 months led to blanket decisions and the lack of preparation time ultimately led to issues for all sides; contractors and engagers. As such the time for review, preparation and education is very much now. It is time for open dialogue and everyone must accept that change is coming. Contracts must be reviewed, potentially difficult conversations must be had, but ignorance will be no defence and IR35 in its new form must be faced head on.